At the forefront of property financing in Costa Rica, GapInvestments.com stands as a beacon for…

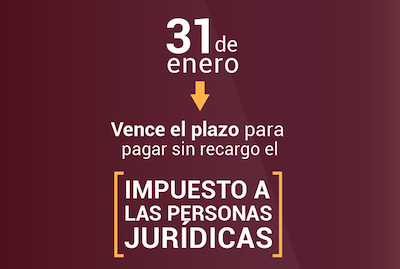

Pay Your Annual Corporation Tax

If you have a corporation in Costa Rica, be sure to pay the annual corporation tax to keep the company in good standing and registered. Inactive companies pay 67,530 colones (about $120 USD as of this writing) and active ones pay amounts ranging from 112,550 colones ($200 USD) to 225,100 colones ($400 USD).

This is due on January 31, 2020, and can be paid at most banks either at the counter or online.

Shareholder Registry: Final Call

The deadline to declare shareholders of Costa Rican companies was extended to January 31, 2020. Read more about the Shareholder Registry here.

What About Income Tax?

All corporations, active or inactive, will need to declare income tax. While this is always been true for active corporations, inactive ones should sign up with Hacienda starting January 2020. Read more: Inactive Companies Must Register and Provide Tax Returns.

The fiscal year has been changed with the new fiscal reform, and now coincides with the calendar year. This means that we are in the 2020 fiscal year that ends December 31, 2020.

If you had a corporation formed before 2019 that had its last fiscal year end in September 2019, you will have a special 15-month fiscal year from October 1, 2019 to December 31, 2020.

At Grupo Gap we can offer you assistance with getting your corporation up to date and securing your investments. Contact us now to set up a consultation!

-Written by Glenn Tellier (Founder of Grupo Gap)

info@gap.cr

Need Residency in Costa Rica? – Click HERE.

Looking for Real Estate? – Click HERE.

Need a loan? – Click HERE.

Want to invest? – Click HERE.

Ready for a Relocation tour? – Click HERE.