At the forefront of property financing in Costa Rica, GapInvestments.com stands as a beacon for…

Due Diligence in Costa Rica

Due Diligence In Costa Rica

Due diligence in Costa Rica is an important concept to consider when engaging in business activities. It involves research into the legal and financial aspects of a proposed transaction, as well as careful scrutiny of any related documents or contracts. This article will provide an overview of due diligence in Costa Rica, identifying key considerations for those wishing to undertake such activity.

The purpose of due diligence is to protect against potential losses that may result from questionable transactions. The process requires examining all relevant documentation, including company filings and other legal instruments associated with the proposed venture. In addition, it includes conducting background checks on individuals involved in the transaction and verifying information provided by them.

Costa Rica has established laws governing due diligence procedures that must be followed if transactions are to remain within the scope of legality. Furthermore, organizations operating in the country must adhere to international standards regarding these processes so as to ensure compliance with local regulations. By understanding the requirements of due diligence in Costa Rica, businesses can make sure their operations are conducted according to best practices.

What Is Due Diligence?

Due diligence is a process of investigation and evaluation that is conducted to ensure the accuracy of information pertaining to an individual or organization. It generally involves examining documents, financial records, tax returns, contracts, and other materials related to the subject. Through this process, investors can identify potential risks associated with their investment decisions. Due diligence also serves as an important tool for companies looking to assess the performance of any given business partner or vendor.

While due diligence often refers to legal compliance when conducting transactions between two entities, it may also refer more broadly to investigations into any type of activity deemed relevant by the party performing the inquiry. This could include researching current trends in industry practices, competitor analysis, market conditions, customer feedback surveys, and so on. The purpose is always to provide stakeholders with actionable insights they need in order to make informed decisions about their investments or partnerships.

Due diligence provides valuable insight into both parties involved in a transaction but should not be taken lightly; all results must be carefully evaluated before any decision is made. With that said, understanding the law regarding due diligence in Costa Rica is essential if one wishes to conduct such activities within its boundaries effectively and legally.

Understanding The Law In Costa Rica

Costa Rica is a civil law system, which means that codified statutes are the main source of law. This system differs from common law systems, where court decisions play an important role in developing legal principles and precedents. Due diligence requires knowledge of the relevant laws and regulations to ensure compliance with local standards when conducting business activities.

Therefore, it is essential for companies who are interested in investing in Costa Rica to have a comprehensive understanding of its legal framework:

* Companies should be aware of any restrictions imposed by legislation as well as other international financial obligations.

* They must also understand labor laws, including minimum wage and employee benefit requirements.

* Furthermore, they need to know about environmental regulations, such as those related to air quality or water pollution.

* Intellectual property rights and data privacy rules should also be taken into consideration, given their importance for businesses operating online or using digital products/services.

* Finally, investors must be familiar with corporate taxation policies and tax incentives available in Costa Rica.

Understanding these laws helps potential investors identify risks before undertaking due diligence procedures on potential investment opportunities in the country. Moreover, having an overview of applicable legal provisions allows new entrants to plan ahead for regulatory changes that might affect their operations over time. The role of an attorney can then be used to help further assess how specific regulations may impact investment plans going forward.

The Role Of An Attorney

When engaging in any kind of business or property transaction, it is important to know the role an attorney plays in due diligence. For example, consider a foreign investor who wishes to purchase a piece of land in Costa Rica and wants to ensure that all necessary legal protocols are observed during the process. In this case, the investor would need access to experienced local attorneys who can provide sound advice about the applicable laws and regulations relating to the transaction.

The primary responsibility of attorneys engaged in due diligence is to review existing records related to a particular asset or transaction. This includes researching public documents such as deeds, surveys, titles, and other official registrations pertaining to the asset. Attorneys must also investigate how previous transactions have been handled with regards to taxes and fees as well as any legal issues that could arise from them. Additionally, they should be able to identify potential risks associated with the transfer of ownership or usage rights for the property being acquired.

Attorneys may also be asked by their clients to conduct interviews with relevant parties involved in a given transaction (e.g., sellers, buyers) so that additional information can be obtained which might not otherwise be available through formal channels. Furthermore, experienced lawyers will typically advise on ways investors can protect themselves against possible future liabilities arising from their activities within Costa Rica’s legal framework – including changes in tax rates or zoning restrictions down the road. As part of their services, attorneys may review contracts and advise on the appropriate language for mitigating risk when needed.

In order for businesses investing abroad or individuals buying properties overseas to make informed decisions regarding their investments, having knowledgeable counsel familiar with local law is essential. An attorney’s expertise enables investors to understand exactly what type of due diligence they should undertake before entering into any agreement involving real estate assets located in Costa Rica.

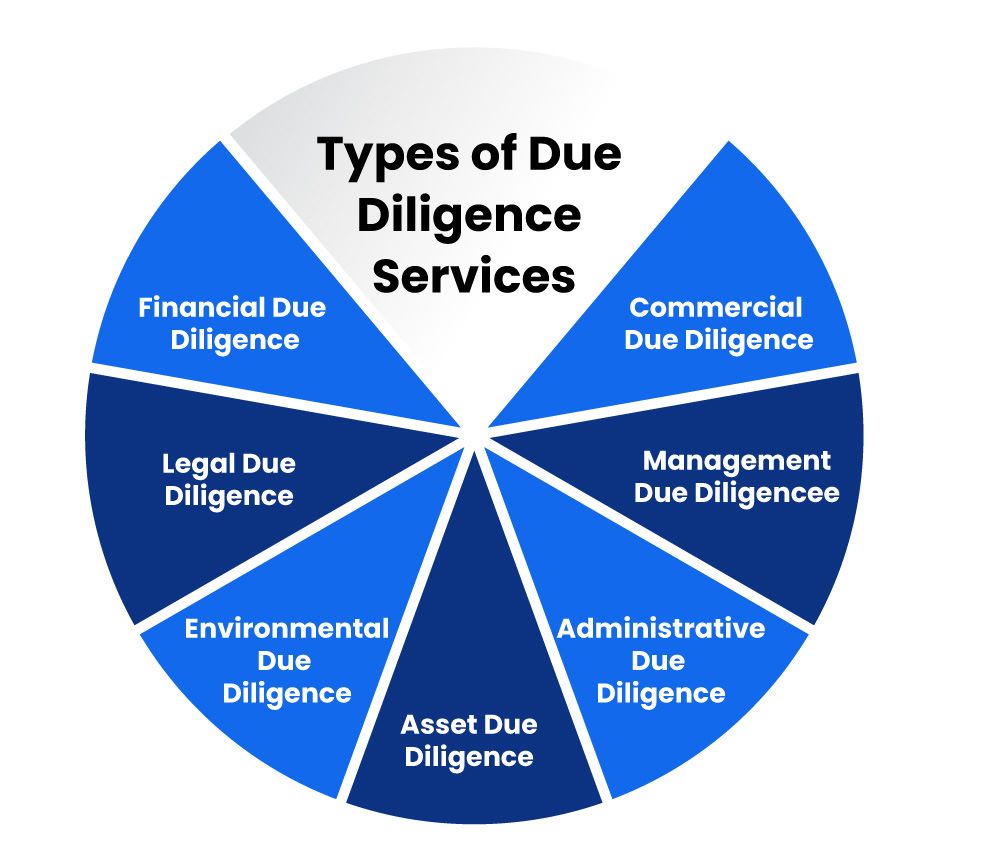

Types Of Due Diligence

Due diligence in Costa Rica is a process of investigation and review used to determine the value, authenticity, or accuracy of business assets. It can involve financial records, legal documents, contracts, or other tangible items that are relevant to an organization’s operations. There are different types of due diligence which can be divided into three primary categories: financial due diligence, legal, due diligence, and market due diligence.

Financial due diligence focuses on analyzing the company’s current financial situation, such as cash flow statements, income statements, and balance sheets. This type of examination also includes looking at any potential pending liabilities that could affect future profits or liquidity. Furthermore, it entails investigating areas such as internal controls and compliance with local regulations regarding taxes and accounting standards.

Legal due diligence involves researching all aspects of the company’s corporate structure including its ownership details and corporate governance policies. Additionally, this covers reviewing existing contractual agreements, including loan documents and leases. Legal due diligence may require obtaining third-party advice from lawyers who specialize in local laws so they can help identify any possible issues related to the target asset or transaction being investigated.

Market due diligence requires gathering information about competitors within the same industry or geographic area as well as analyzing customer trends and preferences for specific products or services offered by the targeted business. Moreover, it provides insights into pricing strategies adopted by competitors while assessing how competitive forces might influence the success of a proposed transaction. This type of research helps investors understand if their investment will yield positive returns over time. With these considerations in mind, investors can make more informed decisions when considering whether to pursue a particular opportunity in Costa Rica. These findings then inform their decision-making process for investing capital in a given venture. Financial records and reports provide further detail on these judgments.

Financial Records And Reports

It is ironic to think that without financial records and reports, conducting due diligence in Costa Rica would be almost impossible. However, with the proper documents at hand and a keen eye for detail, any investor can ensure their funds are well-spent:

1. Examine all previously issued audited financial statements of any potential investments;

2. Obtain pro forma projections from the target company or project sponsors;

3. Request bank references to verify compliance with banking regulations and an understanding of liquidity management practices.

Investors should also pay close attention to recent corporate changes such as new managers, directors, shareholders, capital raises, or debt offerings which may indicate a shift in overall strategy or present opportunities for growth going forward. With these points taken into consideration and properly addressed during due diligence proceedings, investors can feel confident about where their money is being spent when investing in Costa Rica. To assess how those investments interact with local property laws and contracts, it will be necessary for investors to review relevant legal documentation next.

Property Records And Contracts

When performing due diligence in Costa Rica, it is essential to review all property records and contracts associated with the investment. The most important documents are deeds, title certificates, mortgages or liens, tax declarations, and building permits. Before investing in a real estate transaction in Costa Rica, one should consult with an experienced local attorney who can provide legal advice about each of these documents.

The deed is the most critical document for any real estate purchase since it indicates ownership of the property and provides information such as size and boundaries. Title certificates also indicate ownership, but they offer more details, including whether there are pending debts related to the property that must be paid prior to closing on a sale. Furthermore, mortgage or lien documents show if there are any forms of debt owed by either party regarding existing loans or other payments related to the land. Finally, taxes must be taken into account when assessing any potential investment, as failure to pay them could lead to foreclosure proceedings initiated against you. Additionally, certain building permits may need to be reviewed before signing off on a contract agreement in order for investors to ensure compliance with regulations governing construction standards within the area where their intended project will take place.

All these aforementioned documents must be carefully examined during the due diligence process in Costa Rica in order to determine the legality of a given investment and avoid potentially costly litigation down the road. Doing so allows investors to make informed decisions based upon accurate knowledge surrounding their prospective investments while helping mitigate risk associated with making financial commitments without proper research beforehand. This level of foresight paves the way for careful consideration of environmental regulations applicable to future projects, which requires further investigation beyond what has already been discussed here thus far.

Environmental Regulations

Environmental regulations in Costa Rica are stringent, but compliance can be complex. The country has specific environmental laws governing the protection and conservation of land, air, water, biodiversity, and forests. A business needs to meet these requirements when conducting due diligence in the country or risk facing legal penalties. Moreover, there is a wide range of other obligations that must also be considered, such as waste disposal procedures and emissions standards. It is essential for organizations to have an understanding of their responsibilities under the law in order to ensure they remain compliant with all relevant environmental regulations. With this knowledge comes power: the ability to work within the framework of existing laws while protecting both human health and natural resources.

The enforcement of Costa Rican environmental regulations is largely overseen by the Ministry of Environment (MINAE). MINAE works directly with businesses to monitor operations and compliance with applicable laws and regulations; it administers fines if any violations occur. Businesses should familiarize themselves with what MINAE’s role entails before starting a project in the country so they can effectively navigate its regulatory environment.

Navigating complex tax laws and structures often present an additional challenge for companies looking to do business in Costa Rica. Understanding how taxes affect operations is critical, especially given the significant economic implications associated with non-compliance or erroneous payments.

Tax Laws And Structures

In Costa Rica, there are several legislative acts in place that govern taxation laws and structures. The General Tax Law establishes the basis for all taxes within the country; this includes regulations on the registration of taxpayers, filing requirements, withholding tax payments, as well as procedures for determining taxable income and rates applicable to various types of income. The Value Added Tax (VAT) is a primary source of government revenue in Costa Rica; it applies to most goods sold or services rendered by individuals or corporations operating in the country at a rate of 13%. Additionally, capital gains tax may be imposed on any profits derived from real estate transactions or stock market investments made within Costa Rica.

Taxpayers must also take into account local municipal taxes while conducting business activities; these include property tax and occupational tax, which vary depending on the municipality where operations occur. Companies doing business internationally with customers located outside of Costa Rica are subject to special import/export customs duties and fees based on their specific industry sector. Finally, employers have an obligation to withhold employee income taxes as mandated by law; failure to do so could result in significant fines or other penalties being assessed against them.

With careful attention given to each aspect of the national and international taxation system present in Costa Rica during due diligence investigations, investors can effectively avoid potential issues that could arise once operations begin. In order to ensure compliance with relevant regulations related to taxation practices, businesses should consider engaging legal counsel specializing in this area prior to entering the marketplace. Dispute resolution strategies will require close examination when such scenarios manifest themselves between stakeholders involved in commercial activities throughout the region.

Dispute Resolution Strategies

When conducting due diligence in Costa Rica, it is important to consider dispute resolution strategies. In the event of a disagreement or problem between parties involved in a transaction, there are several options available. These include mediation, arbitration, and litigation.

Mediation is an informal process that involves both sides working together with an impartial third-party mediator to reach a solution acceptable to all parties concerned. The mediator facilitates communication between the two sides and assists them in reaching an agreement without resorting to costly court proceedings. Mediation can be used as either a pre-litigation procedure or during existing legal procedures such as litigation, arbitration, or other forms of alternative dispute resolution (ADR).

Arbitration is another common form of dispute resolution that generally involves private hearings overseen by one or more independent arbitrators who make decisions based on the evidence presented by each side. It is typically faster than going through court proceedings since it does not involve any judicial processes. Additionally, arbitral awards are usually confidential and binding upon the parties involved in the case unless otherwise specified in their contract.

The final option for resolving disputes over transactions conducted in Costa Rica is through traditional litigation before courts of law. This may be necessary if no other resolution method proves successful; however, this option presents additional costs and delays associated with filing claims and attending trial proceedings before deciding matters out of court via ADR methods would be preferable when possible. With these considerations in mind, intellectual property rights should also be taken into account when dealing with commercial transactions in Costa Rica.

Intellectual Property Rights

Costa Rica is a party to the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) and offers protection for intellectual property rights. The country has adopted national legislation in compliance with TRIPS, ensuring that all inventors, authors, creators, and other proprietors can benefit from the protection of their works. Costa Rican copyright law protects books, films, music recordings, and broadcasts, as well as computer programs. It also guarantees the exclusive right to exploit literary or artistic work by authorizing its reproduction or distribution, among others.

In addition, trademarks are protected under Costa Rica’s industrial property law, which regulates registration procedures and requirements. Registration grants trademark owners an exclusive right to use it throughout the territory covered by such registration. This creates legal certainty for companies operating in Costa Rica and helps guarantee that they will not be prevented from using their own brands or logos within the country’s marketplaces.

The local government provides active support to protect these intellectual property rights against counterfeiting activities through specific regulation and enforcement efforts, including police raids at establishments suspected of selling counterfeit items. Transitioning into antitrust & competition law: In examining business practices in Costa Rica, it is important to evaluate whether there have been any violations of antitrust and competition laws.

Antitrust And Competition Law

Costa Rica has a robust antitrust and competition law framework. This is set out in the country’s Competition Law, which was enacted in 2005. The purpose of this law is to ensure that businesses conduct their activities with fairness, honesty, and transparency. In addition to protecting consumers from anti-competitive practices such as price fixing or bid rigging, it also seeks to prevent companies from monopolizing markets or abusing their dominant market position. To achieve these goals, the Competition Law sets out various rules regarding pricing, mergers and acquisitions, agreements between competitors, and other forms of unfair business behavior.

The Costa Rican government takes enforcement of its antitrust legislation seriously. Companies found guilty of violating the Competition Law can face significant fines as well as criminal prosecution for individuals responsible for any non-compliance. As part of due diligence when investing in Costa Rica, companies should ensure they are familiar with both the letter and spirit of the Competition Law so as to avoid running afoul of the authorities.

In terms of political stability, Costa Rica boasts an established democracy where the rule of law prevails throughout most parts of the country.

Political Stability

With the business environment in Costa Rica heavily regulated, how can foreign investors ensure that their investments are secure? Political stability is an important factor to consider when conducting due diligence in this Central American country.

To assess political stability, four factors should be taken into account:

1. State of relations with other countries

2. Stability of government institutions

3. Effectiveness of legal framework and enforcement mechanisms

4. Local market conditions

The current state of international relations between Costa Rica and its neighbors has been positive for several years now. The government’s commitment to democracy remains strong, with elections held regularly since 1948 and a system of checks and balances firmly established within the legislative branch. Furthermore, while there have been some issues with corruption over the past few decades, there are strong measures being put in place to tackle it effectively. Finally, Costa Rican markets remain largely open to foreign investment despite ongoing volatility stemming from global events such as Brexit or US-China trade tensions.

Given these considerations, companies looking to invest in Costa Rica need to understand local market conditions and take steps to protect their interests by understanding relevant laws and regulations governing their sector or activity prior to making any commitments on long-term investments or contracts related thereto. As part of this process, they must also assess potential risks associated with operating in what may still be considered a relatively volatile regional context at times. With all these elements assessed appropriately, foreign investors can confidently enter the Costa Rican market knowing that their funds will be protected against unexpected shocks or changes in policy direction. Moving forward then, we must examine local market conditions in order to determine if investing here is suitable for our objectives.

Local Market Conditions

Costa Rica is a small, open economy with low levels of public debt and fiscal spending. The country has experienced strong economic growth over the past two decades due to foreign direct investment in areas such as technology, tourism, and agriculture. Costa Rica’s main export sectors are coffee, bananas, sugar, and textiles. Its currency is the colón (CRC), which is pegged to the US dollar at an exchange rate of 558 CRC per USD. Economic activity in Costa Rica is largely driven by domestic consumption and private investment rather than exports or government spending.

The local legal system provides for reliable protection of property rights and contract enforcement; however, there have been reports of corruption among some officials. Additionally, bureaucracy can be slow and inefficient when dealing with paperwork related to business activities. Despite these challenges, most multinational companies operating in Costa Rica report satisfactory experiences with respect to both cost savings and access to qualified personnel.

Infrastructure development has lagged behind other countries in Latin America; while major highways connect many cities within the country, public transportation systems remain limited outside San José city limits. This can create logistical issues for businesses looking to expand into remote locations across Costa Rica. As such, it is important that investors perform adequate research prior to making any commitments regarding investments or operations in this market.

Reputational Risk Analysis

“Failing to plan is planning to fail”, and this holds true in ensuring a successful due diligence process in Costa Rica. Reputational risk analysis involves assessing the reputation and credibility of an entity, including its business partners, with respect to current events or activities taking place within the country. It is important for businesses seeking investments in Costa Rica to understand their local environment by conducting reputational risk assessments that can help identify potential risks associated with their venture. This assessment should include research into any negative publicity related to the target company’s operations, as well as reviews of any legal action taken against it. Furthermore, entities must consider key stakeholders such as government regulators, customers, shareholders, and employees when assessing possible risks related to reputational damage.

In order to validate an organization’s reputation before investing, it is necessary to collect evidence from reliable sources such as industry news outlets or third-party experts who may have had dealings with the target company. Additionally, companies are advised not only to review existing information but also actively monitor any changes that might affect their investment decision in the future. By gathering accurate data regarding a company’s past performance history and regulatory compliance record, investors can make more informed decisions about whether or not a particular investment opportunity presents value for them.

The importance of performing a thorough reputational risk analysis prior to committing funds cannot be overstated; without proper verification of a firm’s credentials, individuals or organizations could end up subjecting themselves to potentially damaging situations like fraud or financial losses due to unreliable market information. As such, businesses looking at opportunities in Costa Rica should take all available steps necessary when investigating potential investments so they can protect their interests and maximize returns on these ventures. Moving forward then entails considering the potential risks involved when conducting international transactions in Costa Rica.

Potential Risks Involved

The potential risks associated with conducting due diligence in Costa Rica must be considered before any decision is made. These risks can include financial, political, legal, and regulatory conditions related to the country’s economic situation. Additionally, there are numerous reputational risk factors that may affect a company’s ability to successfully conduct its due diligence efforts.

At the most basic level, companies should consider whether or not they have access to reliable information sources within the country. This includes researching local laws and regulations as well as understanding how different sectors of the economy work together. Companies must also assess their own capabilities when it comes to handling issues such as language barriers and cultural differences that could impede the successful completion of the project.

Finally, companies should review existing contracts between themselves and partners in Costa Rica to ensure that all parties are aware of their rights and obligations regarding data management during the process of due diligence. Understanding these elements can help protect against unexpected costs or other surprises down the line. It is important for companies to take into account all possible risks prior to beginning due diligence activities in Costa Rica so that an informed decision can be made about whether or not it is a suitable environment for business operations.

Conclusion

Due diligence in Costa Rica is a critical process for foreign investors. It involves researching and verifying the legitimacy of business operations before investing money in them. This research can be time-consuming and costly, but it ultimately protects potential investors from risks associated with fraud or other legal issues. The average cost of due diligence in Costa Rica varies depending on the type of investment being made, while turnaround times may range from several days to weeks or months.

There are various resources available to aid in due diligence, such as legal consultancies and broker-dealers, that provide guidance throughout the process. Additionally, certain government incentives exist which can help reduce costs associated with due diligence, including tax breaks and exemptions for approved investors. Lastly, there is also a special due diligence process specifically tailored towards foreign investments within Costa Rica’s borders.

Overall, performing due diligence in Costa Rica requires careful research and attention to detail; however, its importance cannot be overstated as it plays an integral role in protecting future investments by ensuring they occur within a safe and secure framework. In short, when considering any kind of financial transaction within this country, one should always take into account the importance of proper due diligence measures before proceeding further.

Frequently Asked Questions

What Is The Average Cost Of Due Diligence In Costa Rica?

Due diligence is the process of researching a potential investment to make sure it meets legal requirements, financial expectations, and other criteria. This research can be conducted in various ways depending on the goals of the investor. In Costa Rica, due diligence typically involves examining relevant documents, interviewing key personnel, and conducting an inspection of physical assets. The average cost associated with this type of investigation varies widely based on factors such as scope and complexity.

In order to accurately determine the cost of due diligence in Costa Rica, investors must assess their needs by outlining specific objectives for their research. It is also important to consider any additional services that may be required beyond the typical tasks included in standard investigations. For example, if an investor requires extra attention or specialized knowledge during their assessment, they may need to pay more than expected. Furthermore, many firms charge different rates based on how quickly they are able to provide results.

The exact cost of performing due diligence in Costa Rica will depend on each individual situation; however, investors should expect expenses ranging from several thousand dollars up to the tens of thousands depending on the scope of work needed. Additionally, there may be travel costs involved if investigators need to visit sites in multiple locations throughout the country. To ensure adequate budgeting for these types of projects, investors should obtain detailed estimates from qualified companies before starting any due diligence inquiry in Costa Rica.

What Is The Turnaround Time For Due Diligence In Costa Rica?

Due diligence is an important process when making any business decision. It involves researching a company or individual to assess their reliability and determine the risks associated with engaging in a transaction with them. Generally, due diligence consists of gathering data and information from various sources such as financial statements, contracts, legal documents and more. This article will focus on the turnaround time for due diligence services in Costa Rica.

The average turnaround time for due diligence services in Costa Rica can vary depending on several factors:

1. The complexity of the project – Projects that involve multiple entities may take longer than those involving only one entity.

2. The amount of research required – More thorough investigations require more resources which can lead to longer turnaround times.

3. Accessibility to relevant information – Having restricted access to certain documents or databases can also cause delays in completing due diligence projects.

In order to meet deadlines, it is essential for companies conducting due diligence in Costa Rica to have an efficient workflow management system in place that allows teams to quickly collect and analyze data from all sources efficiently and accurately. Investing effort into streamlining processes can help reduce overall turn-around times significantly while still ensuring the accuracy of results obtained from the investigation process. Additionally, having good relationships with local authorities is key as this helps facilitate timely access to necessary information when doing due Diligence work in Costa Rica.

It is important for businesses entering into transactions with partners based outside their home country to understand what goes into performing a successful Due Diligence investigation prior to committing resources so they are adequately prepared for potential delays caused by any of the aforementioned factors mentioned above before entering into agreements with foreign entities engaged in business activities within Costa Rica’s borders. Taking these steps will ensure that businesses make sound decisions without compromising on quality or timeline expectations when dealing with international counterparts.

What Resources Are Available To Aid In Due Diligence In Costa Rica?

When it comes to business transactions and investments, due diligence is an integral part of the process. It involves researching and assessing any potential risks associated with a transaction before proceeding. In Costa Rica, due diligence is no different; resources are available to aid in this important step.

The key components of successful due diligence include market research, financial analysis, legal review, and environmental assessment. Doing so helps companies make informed decisions about their investments by providing them with the most up-to-date information possible. Fortunately, there are many resources available in Costa Rica that can help businesses perform due diligence effectively and efficiently.

Government agencies like InvestCostaRica offer advice on conducting due diligence in the country, as well as assistance for foreign investors who need help navigating local laws and regulations. Additionally, professional services such as law firms provide legal counsel related to contractual matters or dispute resolution processes. And finally, private organizations offer specialized services such as background checks and investigations into potential partners’ or customers’ financials.

Resources like these give companies access to invaluable insights that can help protect their investments while ensuring compliance with all relevant laws and regulations. With access to reliable data and expert guidance from knowledgeable professionals, businesses can be confident they are making smart decisions when it comes to their activities in Costa Rica.

Are There Any Government Incentives For Performing Due Diligence In Costa Rica?

Due diligence is a process of researching and verifying the accuracy of information. It involves examining records, documents, or other data to ensure that all relevant facts are considered before making a decision. In business transactions, due diligence may be necessary to assess the risk associated with a particular investment opportunity. This paper will discuss whether there are any government incentives for performing due diligence in Costa Rica.

Costa Rica has laws in place that encourage foreign investment by providing various tax incentives and exemptions from certain regulations. These include reduced income taxes on profits generated from exports, as well as special deductions available to businesses operating within free trade zones. Additionally, research conducted into potential investments can also benefit from incentives such as grants and subsidies provided by the government through its Invest-in-Costa-Rica program.

In terms of performing due diligence activities specifically related to foreign investments in Costa Rica, investors should first consult their local legal advisor regarding the applicable laws and regulations in order to determine if they qualify for any specific benefits or assistance programs offered by the government. Investors should also consider utilizing professional services providers who specialize in conducting detailed due diligence investigations on behalf of companies looking to invest abroad. Such service providers have extensive experience working with local authorities and understand how best to leverage existing resources for maximum efficiency when carrying out these types of investigations. Ultimately, understanding the range of incentives available can help maximize returns while minimizing risks associated with investing in this country.

Is There Any Special Due Diligence Process For Foreign Investors In Costa Rica?

Due diligence is a process that involves conducting research and analysis to investigate the potential risks or rewards of any particular action. It is an important factor for foreign investors when considering investments in Costa Rica. This paper examines the special due diligence process for foreign investors in Costa Rica, as well as its associated benefits:

First, it is important to understand what specific steps are involved in performing due diligence in Costa Rica. Generally speaking, this includes obtaining information about current laws and regulations, researching the company’s history and reputation, understanding the competitive landscape, analyzing financial statements and other records, assessing legal documents related to contracts, leases and other agreements, and consulting with experts on relevant topics such as taxation.

To maximize success within this process, there are also certain government incentives available to encourage foreign investment into Costa Rica. These include tax exemptions based on foreign direct investment criteria; business support services from local institutions such as chambers of commerce; subsidies for research & development activities; access to venture capital funds; export promotion programs; preferential treatment under free trade agreements; and technical assistance grants.:

* Tax Exemptions

* Business Support Services

* Subsidies for Research & Development

Investors must be aware of these incentives before embarking upon their due diligence process in order to ensure they take full advantage of them. Additionally, since each incentive may have different requirements or restrictions attached to it, it is advisable that investors consult with legal professionals who can provide further guidance throughout the process. Ultimately, by thoroughly comprehending all aspects of due diligence prior to making any decisions regarding investments in Costa Rica will lead to increased prosperity over time.

-Written by Glenn Tellier (Founder of Grupo Gap)

info@gap.cr

Pura Vida!

Need Residency in Costa Rica? – Click HERE.

Looking for Real Estate? – Click HERE.

Looking for investment opportunities? – Click HERE.

Ready for a Relocation tour? – Click HERE.