At the forefront of property financing in Costa Rica, GapInvestments.com stands as a beacon for…

Property Taxes in Costa Rica

Property Taxes in Costa Rica: A Comprehensive Guide

In Costa Rica, property taxes are called Impuesto Sobre Bienes Raices, or Real Estate Taxes. The national government administers the tax system and applies to all property owners, regardless of citizenship. The taxes are calculated based on the property’s value and are due quarterly, or you can pay annually for usually a small discount (around 4%) and get it out of the way.

It’s important to note that the local municipal government determines the property’s value for tax purposes and may not necessarily match the market value. If you disagree with the assessed value, you can request a reevaluation from the government, but this process can take several months to complete.

This guide will help you better understand property taxes in Costa Rica and what you can expect when paying them.

How property taxes are evaluated

The property owner must provide the municipality where the property is located with a “Property Declaration Form” (Declaración de Bienes Inmuebles) at regular intervals of five years. Even if the owner is the one who fills out the form stating the value, the municipal government nevertheless has it looked over to ensure that the values given are acceptable. Many of these entities keep a database of property values, and they want you to set values in your declaration consistent with the criteria they have established for property valuation. It may audit the filing if it considers that the value mentioned in a file is less than those found in its valuation manuals.

Some municipalities have begun to implement penalties for failing to file, such as a fine that might be equivalent to the sum of the new appraisal’s value and the amount of property taxes you have already paid on the property.

Transfer Tax (Impuesto de Transferencia)

The tax rate will be one and a half percent (1.5%) of the property’s sale price or assessed value, ultimately going with the higher value.

For example, if the sale price of your property is $1,000,000 USD and the tax rate is 1.5%, your Transfer Tax would be $15,000 ($1,000,000 x 0.015 = $15,000). Remember that this is just a rough estimate and that your actual taxes could be more or less than this, depending on the market value of your home and the rate of taxation in your municipality.

Property tax

According to Law 7509 Real Estate Tax Law, “ARTICLE 23.- Percentage of the tax. Throughout the country, the tax percentage will be one-quarter percent (0.25%) and be applied to the value of the property registered by the Tax Administration.” This is the case throughout the entirety of Costa Rica.

For example, if you own a property worth $200,000, with the tax rate at 0.25%, your annual Property Tax you can expect to pay around $500 in property taxes yearly ($200,000 x 0.0025 = $500). It’s worth noting that this is just an estimate, and your actual taxes may be higher or lower depending on the value of your property and the tax rate in your area.

Luxury tax

Article 4 of Law 8683 Solidarity Tax Law states that law 8683 Solidarity Tax Law any residence with a construction value of 148,000,000 colones (approximately $259,000 USD) is subject to the luxury home tax as of 2023. The tax rate varies depending on the property’s location and its registered value, with rates ranging from 0.25% to 0.55% of the property’s value. This tax applies to all properties, whether they are residential, commercial, or industrial.

There can be a few exceptions to the Municipal Luxury Tax. Some properties used for agricultural purposes, such as farms and ranches, could have tax exemptions. Additionally, some properties used for religious or charitable purposes could also be subject to exemptions.

Corporations

Corporate taxes are fairly open-ended since there are several. Companies are usually required to make their annual tax payments in January. The administrative fee for the Ministerio de Hacienda (also known as the tax authorities) is approximately 80,000 colones, equivalent to roughly $140 USD.

If you do not pay your corporate taxes, you may run the risk of having your company dissolved, which could slow down the process of selling your property. This risk is increased if you do not pay your corporate taxes. Because correcting this could result in legal fees costing thousands of US dollars, so we strongly recommend that you always stay on top of your taxes.

The Shareholder’s Declaration, also known as the RTBF yearly declaration, ensures that organizations have the most recent information regarding their beneficial owners and shareholders. The deadline is usually on April 30 of each year.

The assets, liabilities, and equity of inactive corporations that don’t engage in commercial activity or company must be disclosed in Costa Rica. To finish this process, you will need a certified public accountant. This obligation can be satisfied by representing a Costa Rican attorney, and it applies to all corporations operating in Costa Rica. The 15th of March serves as the annual filing deadline for this declaration.

Due Dates

Due dates to pay your taxes quarterly are March 31, June 30, Sept 30, and Dec 31.

Note: Some smaller communities won’t take credit cards, while others might have an online payment system. Since this varies, it is in your interest to learn about future online payments that may be done using a less cumbersome tactic, such as a BCR account.

Other Taxes in CR

- Excise tax: An excise tax may be levied on certain luxury goods, such as high-end cars and boats.

- Environmental tax: A tax may be levied on activities considered harmful to the environment, such as mining and deforestation.

- Customs duties: If you import goods into Costa Rica, you may be subject to customs duties. The rate of customs duties varies depending on the imported goods.

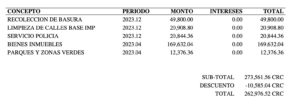

Here is a list of taxes from the municipality for a property valued at around $115,000 USD in Santa Ana.

What Happens to the Property Taxes?

To the best of our knowledge, the following is the breakdown of the property taxes that homeowners pay to the government in their respective communities: The National Revenue Department pays for 1% of the cost of assessment training for local municipal governments; 3% goes to the National Property Registry; the Board of Education receives 10% of the money from each regional Canton; administrative expenses related to tax collection are allocated 10% of the budget; and the remaining 76% is given directly to regional municipal authorities.

Conclusion

Overall, property taxes in Costa Rica are considered to be relatively inexpensive by most standards. Still, they are just one of many factors to consider when purchasing a property in the country. By understanding how they are calculated and what you can expect to pay, you can make informed decisions about your investment. With its stunning scenery and relaxed lifestyle, Costa Rica is an attractive destination for property owners and a great place to call home.

-Written by Glenn Tellier (Founder of Grupo Gap)

info@gap.cr

Frequently Asked Questions

What are property taxes called in Costa Rica?

Property taxes are called Impuesto Sobre Bienes Raices, or Real Estate Taxes in Costa Rica.

Who administers the property tax system in Costa Rica?

The national government of Costa Rica administers the property tax system.

Are property taxes in Costa Rica based on the market value of the property?

No, property taxes in Costa Rica are based on the value determined by the local municipal government for tax purposes.

Can property owners request a reevaluation of their property’s value for tax purposes?

Yes, property owners in Costa Rica can request a reevaluation of their property’s value, but the process can take several months to complete.

How often do property owners need to file a Property Declaration Form in Costa Rica?

Property owners in Costa Rica need to file a Property Declaration Form at regular intervals of five years.

Are there penalties for failing to file a Property Declaration Form in Costa Rica?

Yes, some municipalities in Costa Rica have implemented penalties for failing to file, such as a fine equivalent to the sum of the new appraisal’s value and the amount of property taxes already paid.

What is the Transfer Tax in Costa Rica?

The Transfer Tax in Costa Rica is one and a half percent (1.5%) of the property’s sale price or assessed value, ultimately going with the higher value.

Is there a Luxury Tax in Costa Rica?

Yes, there is a Luxury Tax in Costa Rica, which applies to properties with a construction value of 148,000,000 colones (approximately $259,000 USD) or more.

Are there any exceptions to the Municipal Luxury Tax in Costa Rica?

Yes, some properties used for agricultural purposes or religious or charitable purposes could be exempt from the Municipal Luxury Tax in Costa Rica.

What happens if a property owner does not pay their corporate taxes in Costa Rica?

If a property owner does not pay their corporate taxes in Costa Rica, they may run the risk of having their company dissolved, which could slow down the process of selling their property.

“Grupo Gap are a lifesaver! They helped me get the funding I needed for my small business. 10/10 would recommend.” -John

Contact us now to learn more about lending or borrowing in Costa Rica HERE!

Need Residency in Costa Rica? – Click HERE.

Looking for Real Estate? – Click HERE.

Need a loan? – Click HERE.

Want to invest? – Click HERE.

Would you be ready for a Relocation tour? – Click HERE.